Recently, a local customer stopped by our showroom to purchase an Austin air purifier to help with her asthma and allergies. While she was here, she mentioned that she recently replaced the flooring in her home. Like many people coping with asthma and allergies, she was asked by her doctor to remove carpet and replace it with more allergy-friendly smooth flooring. After discussing the matter with a Certified Public Accountant (CPA), she discovered this renovation was actually tax deductible. Here’s the skinny on how a doctor recommended home renovation might help lower your tax bill. Recently, a local customer stopped by our showroom to purchase an Austin air purifier to help with her asthma and allergies. While she was here, she mentioned that she recently replaced the flooring in her home. Like many people coping with asthma and allergies, she was asked by her doctor to remove carpet and replace it with more allergy-friendly smooth flooring. After discussing the matter with a Certified Public Accountant (CPA), she discovered this renovation was actually tax deductible. Here’s the skinny on how a doctor recommended home renovation might help lower your tax bill. |

How This Could Apply to Those Coping With Allergies or Asthma |

Many doctors often recommend that you remove carpet from your home. Carpet is notorious for trapping the most common household allergen – dust mites. Pollen mold, and pet dander are also often deeply embedded in the carpet fiber or padding. Even powerful vacuum cleaners like Mieles cannot extract these allergens once they have made their way into the carpet pad, and all of these can be persistent irritants for those struggling with allergies and asthma. Many doctors often recommend that you remove carpet from your home. Carpet is notorious for trapping the most common household allergen – dust mites. Pollen mold, and pet dander are also often deeply embedded in the carpet fiber or padding. Even powerful vacuum cleaners like Mieles cannot extract these allergens once they have made their way into the carpet pad, and all of these can be persistent irritants for those struggling with allergies and asthma. |

How Would I Deduct a Home Renovation? |

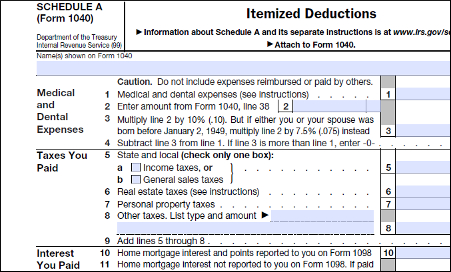

For many people replacing carpet isn’t an option. Either you are renting or perhaps it is too expensive. However, after speaking with local CPA George Baker of Tucker, GA, I discovered that you may be able to deduct the expense of a project like this from your taxes. As Mr. Baker explains, if you can show that the renovation was done due to a doctor recommendation (it is best to have you doctor write a prescription for the renovation), it is likely tax deductible. Replacing carpet with hardwoods, laminate or another type of smooth flooring? More than likely, it’s tax deductible. Ultimately, this type of expenditure would be filed under Schedule A (medical expenses), an attachment to the standard 1040 tax form. For many people replacing carpet isn’t an option. Either you are renting or perhaps it is too expensive. However, after speaking with local CPA George Baker of Tucker, GA, I discovered that you may be able to deduct the expense of a project like this from your taxes. As Mr. Baker explains, if you can show that the renovation was done due to a doctor recommendation (it is best to have you doctor write a prescription for the renovation), it is likely tax deductible. Replacing carpet with hardwoods, laminate or another type of smooth flooring? More than likely, it’s tax deductible. Ultimately, this type of expenditure would be filed under Schedule A (medical expenses), an attachment to the standard 1040 tax form.

A more traditional example of this would be for those who now find themselves having to use a wheelchair. If you became wheelchair-bound and had to make home renovations to lower things in your home, putting them in reach while in the chair, or build a ramp to get into your home, both would be examples of tax deductible renovations that would be covered by the medical exemption clause. |

Are There Exceptions to This, and How Do I Go About Finding Out? |

There is at least one caveat to this. The tax exemption clause applies to changes you would make to your home, like a renovation project. This does NOT apply to appliance purchases like HEPA air purifiers or vacuum cleaners… mostly. I do pause after I say this, and the main reason is because some systems, particularly a whole home system, might qualify. This type of whole-home filtration isn’t like a traditional room air purifier. Instead, it is built right into your existing HVAC structure, and if a doctor were to prescribe this to improve a medical condition, it actually might qualify as tax deductible. There is at least one caveat to this. The tax exemption clause applies to changes you would make to your home, like a renovation project. This does NOT apply to appliance purchases like HEPA air purifiers or vacuum cleaners… mostly. I do pause after I say this, and the main reason is because some systems, particularly a whole home system, might qualify. This type of whole-home filtration isn’t like a traditional room air purifier. Instead, it is built right into your existing HVAC structure, and if a doctor were to prescribe this to improve a medical condition, it actually might qualify as tax deductible.

The key with any change like this is your doctor suggests it and signs off on it. I would highly recommend you contact your local CPA or tax professional before you start any project and for further advice. And, with tax time just around the corner, now might be as good a time as any to take advantage of this potential key deduction on your 2014 tax return. |